- Unlocking Financial Freedom

Empowering your financial future

We help individuals and businesses grow wealth, reduce risk, and achieve long-term success.

- About Us

Empowering businesses and individuals with experts

Expertise You Can Trust

Our experienced team delivers reliable insights and strategies, ensuring your financial decisions are well-informed and secure.

Personalized Solutions

Our personalized solutions are crafted address your unique financial helping you achieve your specific goals and aspirations.

Proven Track Record

Our proven track record highlights successful outcomes and client satisfaction through effective financial solutions.

- Our Services

Expert financial services for your needs

Financial Planning

Strategic Business Consulting for Growth Success

Business Consulting

Comprehensive Financial Planning for Your Future

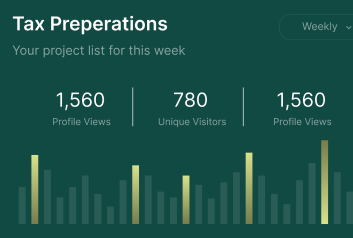

Tax Preparation

Expert Tax Preparation for Maximum Savings

- Our Expertise

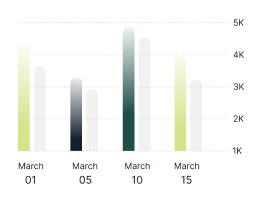

Driving innovation and success in Industry Insights

Benefits Of Our Financial

- Expert Investment Management

- Social Security And Pension Optimization

- Business Financial Planning

- Our Products

Discover Our Full Range of Financial Solutions

Our range of tailored financial products is designed to support every stage of your wealth journey. Whether you’re planning for retirement, managing investments, or growing your assets.

The Handbook of Financing Growth: Strategies, Capital Structure, and M&A Transactions

$105.00 Original price was: $105.00.$45.27Current price is: $45.27.

- Our Approach

Client centric strategy for lasting success

- Why Choose Us

Expertise and client focused solutions for your success

01

Unparalleled Expertise

Our team comprises seasoned professionals with extensive.

02

Cash Flow Optimization

03

Financial Accountability

- Key Features

Innovative solutions elevate your financial experience

Personalized Financial Planning

Crafting tailored strategies to align with individual financial objectives.

Expert Investment Management

Professional oversight to optimize investment portfolios for growth and risk mitigation.

Real Estate Investment Advice

Guidance on property investments for income generation and capital appreciation.

- Financial Wisdom

Fascinating facts that shape your financial knowledge

The number of publicly traded companies

The number of publicly traded companies

The number of credit cards in circulation

The proportion of Americans who believe that financial literacy

- Get A Free Quote

Take control of your financial future today!

- Testimonial

Genuine reviews from satisfied customers

Discover how Financial Wealth Plan has helped individuals and families achieve financial clarity and confidence. Our clients’ success stories reflect the trust, care, and results we strive to deliver every day.

The team provided exceptional financial guidance tailored to my needs. Their expert advice helped me grow my investments while ensuring financial security for the future.

- Frequently Asked Questions

Common business & finance questions and answers

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

- Latest Post

Top Strategies to Boost Your Business Financial Growth